Did you know that over one-third of businesses that go through a disaster or property loss never open their doors again? This is primarily due to insufficient insurance or the inability to prove the value of equipment and other assets lost in the event. How do you protect your business against this kind of unexpected problem? An accredited equipment appraisal with a signed certification can go a long way towards ensuring you have adequate insurance to protect against a loss and to support equipment values during an insurance loss settlement.

Involved in an Insurance Loss Claim for Machinery & Equipment? Accredited Appraisals Will Assist in the Process.

Determining Insurance Coverage

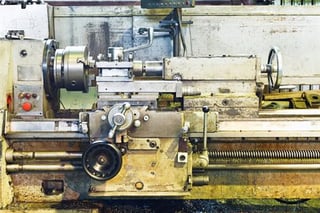

When you are buying business insurance, you want to make sure all your assets, including machinery & equipment, are being covered for their current market or replacement cost value. Many people rely on tax return depreciation as a quick guide to appraising it, but the actual value may be much different than what standard accounting depreciation allows.

If the machinery & equipment is overvalued, you may be paying too much for premiums and will not recover the full amount you have estimated during a loss claim. If the assets are undervalued, the insurance company may have concerns that you did not pay for sufficient coverage and not be willing to pay you a fair value for casualty claims. An accredited machinery & equipment appraisal can go a long way to providing proof of value for your assets and assist in determining how much coverage you need.

Dealing with a Loss

When your business suffers an actual casualty loss, during this stressful time, you will want to reach a fair settlement as quickly as possible, to avoid business interruption. Can you prove what your equipment was actually worth? Having support documentation completed by an accredited machinery & equipment appraiser with signed certification helps to prove the real market value and can be utilized in an insurance settlement. The valuation is an objective, unbiased, defendable report that you can present to the insurance company during the claim process.

Even if you have not had a report completed before the loss, appraisers can retrospectively value the machinery & equipment as of the casualty loss date. An accredited equipment appraiser will sign a certification attesting to the value as of the prior loss date. They have the experience and expertise to research the market and make the appropriate adjustments to reflect market value as of the effective date. Make sure the firm employs accredited valuation experts who are members of the American Society of Appraisers (ASA). This ensures they follow the protocols of providing objective, supportable reports that will hold up in any settlement negotiation.