You have spent years building up your business, invested wisely, accounted for risk, and sacrificed a lot to build your company into what it is today. You have groomed the next generation of your family and employees to one day take over the legacy you have created.

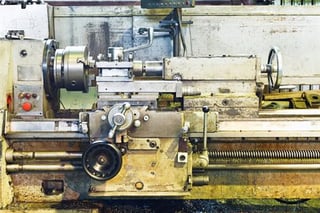

If you own a significant amount of machinery & equipment as part of your business, have you accounted for gift or estate taxes in your planning? With the potential liability of these taxes, failing to plan for them can leave your legacy open to unnecessary costs. You can avoid this pitfall by obtaining an accredited machinery & equipment appraisal with signed certification that attests to an objective, fair opinion of value.

Whether you are planning on handing down the business or just need to update the current value of your tangible machinery assets for internal or external purposes, a documented appraisal report will satisfy several needs. It can assist in limiting any disputes in value by those taking over the business, where one family member, partner, or vested employee thinks they are getting more or less than another. If your estate and it’s associated company is being divided up between several people, an accredited equipment appraisal will help determine how all the assets can be equally divided. If you are planning on using a living trust, it also has the advantage of keeping your loved ones out of probate and will keep your accounting and wealth private.

Making Arrangements for Estate and Gift Taxes

When you have a supportable, independent equipment appraisal report in hand, you can then estimate how much these burdensome taxes may be and make allowances for them either through life insurance, business insurance, or by leaving a certain amount of equity available to cover these estate costs.

If you are thinking of estimating these values internally by simply looking for similar equipment online or finding a broker, auctioneer, or other unaccredited third parties to estimate value, you risk not having an objective, reliable report. This may cause concern by those auditing your business for estate tax purposes.

Make sure you employ accredited valuation experts who are members of the American Society of Appraisers (ASA). This ensures they follow the protocols of providing objective, supportable reports that will hold up in any business situation.