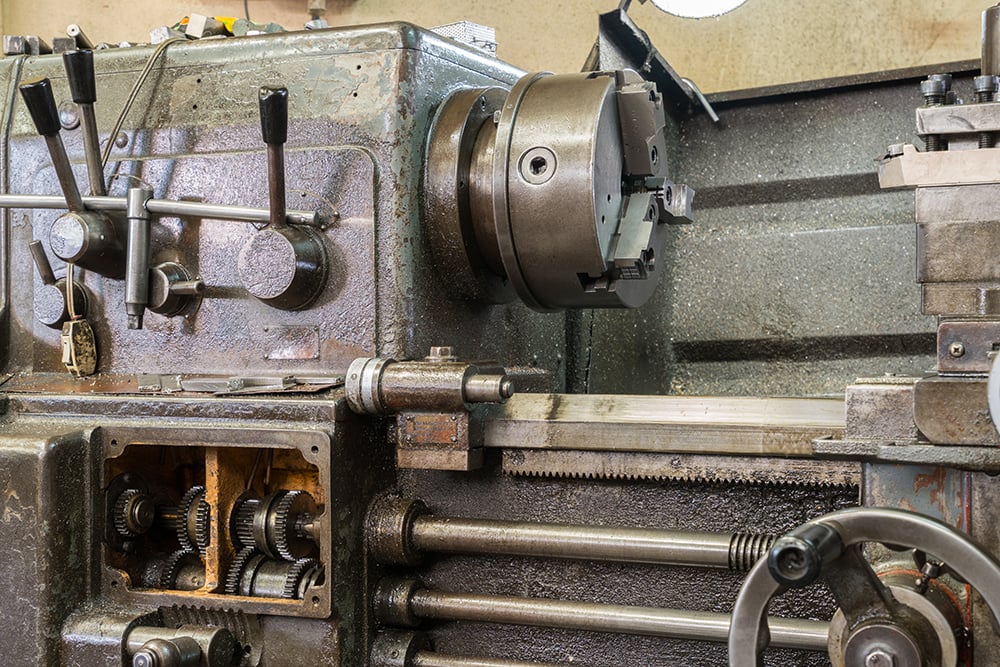

Have you ever driven by an abandoned facility or work site and seen equipment that looks like it has been sitting there for months or even years, neglected and exposed to the elements? You can tell just from a casual view that the machinery is in dire need of major repair work or is otherwise headed to the junkyard.

This may be an extreme and broad example of how the value of equipment can be greatly affected by lack of maintenance, however, from an appraiser’s perspective, the history of an asset’s operation and care is a critical component to supporting value.

Most accredited and certified appraisers are not mechanics or technicians, and therefore cannot independently assess the cost of bringing equipment back into good operable condition. Therefore, an assumption is typically made stating that the associated values assume normal conditions exist, or they receive details from the owner or a qualified third party stating otherwise.

Even when a general visual inspection is part of the valuation effort, it is assumed that normal operating conditions exist, and effective maintenance history has been completed over the life of the assets unless the appraiser is told otherwise. If it is evident during the inspection that the assets have been out of service for an extended period and need repair work, the appraiser can apply a reasonable penalty to account for this, however, without support of the specific circumstances, the adjustment will be very broad in nature.

The fact is that in any situation, the appraised value is heavily predicated on the assumption that a potential buyer will be able to operate the equipment with minimal to no reinvestment once ownership changes hands. If the appraiser knows this is not a correct assumption, then they must determine a way to account for this that can be supported by their experience or ideally with a qualified assessment of repair costs.

Poor maintenance practices and long-term lack of use will eventually lead to a shortened life and significant repair costs for virtually all types of equipment, vehicles, and even certain personal property. If you own these types of assets and you know they will be out of service for an extended period, it is important to store them in a protected environment and keep the components running once a week or so to maintain them properly. This way, when it comes time to use them again or sell them on the open market, you can rest assured they will function reliably for you or your buyer.