Depending on the industry, the equipment that works within it can be relatively mobile or stationary. The more immobile assets may involve significant costs in addition to the actual purchase price of the machinery itself. These expenses include shipping, installation, project management, engineering, electrical, plumbing, and operator training. These extra investments are necessary to get the equipment up and running. For mobile assets, these variables will be much less of a factor in a potential transaction.

From an appraisal perspective, this creates the need to further define Fair Market Value beyond just the “hard” costs. Fortunately, the American Society of Appraisers (ASA) has developed definitions to consider these potential scenarios. Two of the most common are Fair Market Value-Installed and Fair Market Value-Removed. With each definition, it takes the initial premise of value and expands upon it to further clarify its parameters.

For comparison, here are the definitions as stated by the ASA:

Fair Market Value

Fair Market Value is an opinion expressed in terms of money, at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell, and both having reasonable knowledge of relevant facts, as of a specific date.

Fair Market Value-Removed

Fair Market Value-Removed is an opinion expressed in terms of money, at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell, and both having reasonable knowledge of relevant facts, considering removal of the property to another location, as of a specific date.

Fair Market Value-Installed

Fair Market Value-Installed is an opinion expressed in terms of money, at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell, and both having reasonable knowledge of relevant facts, independent of earnings generated by the business in which the property is or will be installed, of a specific date.

The bolded words within the refined definitions provide additional perspective based on two different scenarios. For mobile assets, these values will not be much different, if at all; however, for certain types of manufacturing and processing equipment, for example, it may be significant.

If the appraiser is valuing an over-the-road truck or trailer, they would just use the premise of Fair Market Value, as installation and removal costs would not be material.

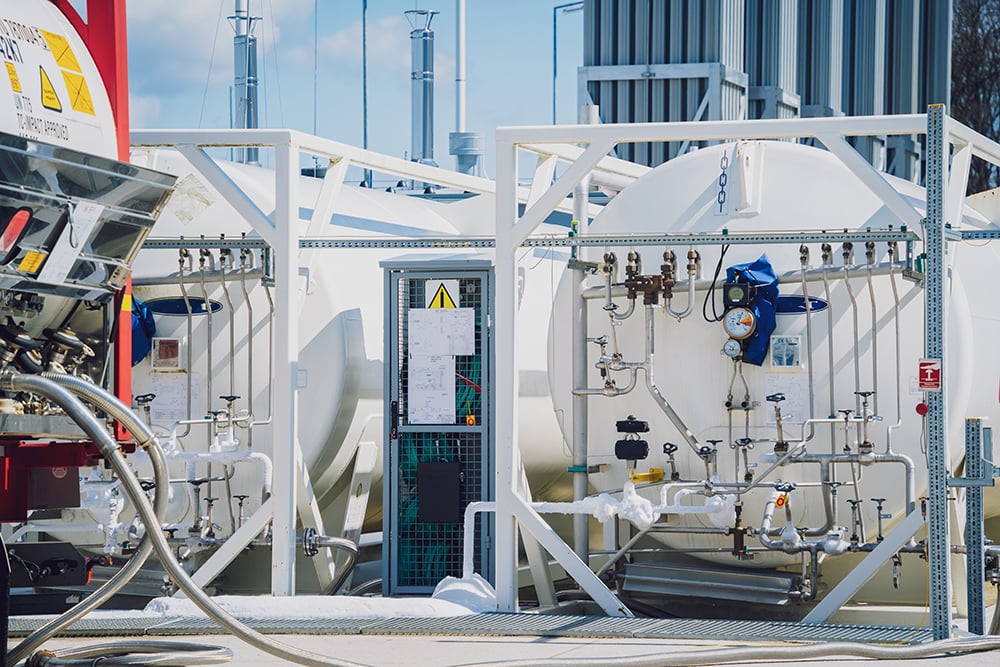

However, for a large multi-component material handling line in a processing facility, the value on an installed basis will likely be significantly higher than the removal cost. The requirements necessary to ship these types of assets, add extra foundations to install them safely, all utility line hookups needed, and potentially paying the manufacturer reps for weeks of on-site training, are some of these costs that would have value on an installed basis but not in a removed situation.

In summary, it is important for both the appraiser and the client to determine the most appropriate definition of value to use in any given situation. Communicating the purpose of the appraisal and discussing the big-picture perspective, along with the owner/buyer/lender/investor’s goals, will help determine which approach makes sense.