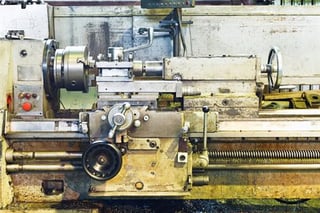

When you run a business, you know that to roughly paraphrase Benjamin Franklin, failing to plan is planning to fail. If you don't know what direction your company is going in, how to respond to changing market conditions or even where your company is strong and weak, you can't take advantage of opportunities and avoid risks when they come along. But even for those business owners or managers who do business planning for their enterprise, there can be some areas where you don't know exactly what you're working with. One of these areas is equipment values.

How Equipment Appraisals Help You Get the Most out of Your Business Planning

Often typing up significant amounts of equity, deciding on a timeline for equipment purchase or replacement and what type of transaction to undertake can be difficult to determine. Here are some examples of how an equipment appraisal can help in the business planning process:

- When to purchase machinery. Should you purchase new equipment before starting that new contract or after it's completed and paid? The biggest part of that answer hinges on how much longer your equipment is expected to last. Though a exact point of failure or the point at which it becomes unprofitable to continue repairing is hard to determine, a qualified machine appraiser can estimate a piece of equipment's remaining usable life will be. By knowing this, you can determine whether the existing equipment will make it through the contract or if it has potential to break down and cause serious delays and financial burden.

- When to sell equipment. If you're hitting a problem point in your cash flow, should you sell equipment or take out a line of credit to cover the lean times? An equipment appraisal allows you to know what your machinery is actually worth by looking at the current market conditions. If your industry is going into a bust cycle, you may not get much money for the equipment you'd need to sell. If, on the other hand, it's going into a boom cycle, you may want to hold onto the equipment regardless to take advantage of favorable conditions. A machine appraisal could help with this type of information.

- Buying new or used or trading in. What type of purchase should you make? If you're considering buying new, can you save significant money by buying used instead? If you're thinking of buying used, would a new machine provide a significantly longer useful life for just a little more cash? Should you buy more equipment or just upgrade by trading in your old machinery? A good machine valuation specialist can help answer those questions by letting you know what your equipment is worth. By going into a dealership prepared with the current machinery values, you're able to negotiate from a position of strength.

When you have a machine appraisal performed, that information helps lead to better business planning in the future. By having a solid plan in place that reflects accurate information for your business, you can successfully grow your business.