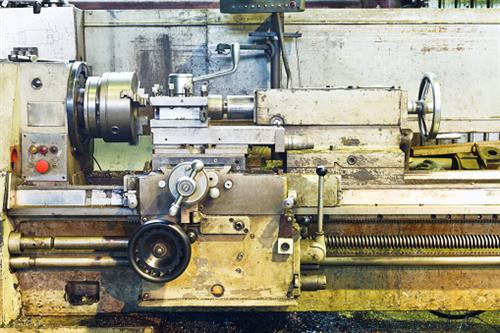

When your business is looking to acquire new equipment, one of the primary reasons that necessitate this is the need to replace older machinery and upgrade your company’s production capabilities. Your first instinct may be to trade in or resell your used assets, however, another effective option is to donate them to a local non-profit, such as a public school/university, hospital, research institute, charity, museum, or other tax-exempt organization.

Consider researching options locally or contact your old schools to see if they would be interested in acquiring the used equipment which they might utilize directly or be able to refer you to a facility they know might have an interest.

The benefits to this type of transaction are not only from an income tax deduction perspective but you can also provide goodwill for your business. You may also be helping another facility and the individuals they support by providing items they might not be able to afford otherwise. Scientific, medical, and technical research and education at the high school and college levels are areas that usually need resources to maintain and grow their foundations.

Before physically donating, make sure you check that the equipment is in good working order while cleaning it up and creating an itemized list of what you will be providing to the non-profit organization. This list will come in handy when filing your taxes as well.

If you know the overall value of your donated machinery will exceed $5,000, you will be required to obtain an appraisal to support the higher claim. The advantage you have here is that the price level will be measured at fair market value, which is very likely higher than any trade-in or resale price you might get from an equipment dealer if you tried to sell on your own.

>Look to engage with an experienced accredited appraiser who is familiar with the type of assets you are donating. Donation valuations are very common for equipment appraisers, and they can provide the support needed to ensure you receive a reasonable assessment of value.

Once the appraisal is completed, you will need to fill out an IRS form 8283 for noncash donations and have the appraiser review and attest to the reported value. You can submit this as part of your overall tax return.

Donations can also be completed for unused inventory such as spare parts and tooling. Companies that produce excess finished goods can also donate these items using the same process. Equipment appraisers with experience in valuing inventory can work with you on these types of donations as well. In summary, before you decide to resell your used machinery when replacing them with newer models, consider a donation as a more effective alternative.