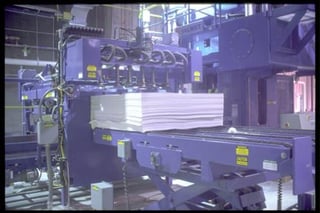

When it comes time to have a business appraised, whether it’s for a potential sale, purchase, re-financing, new partner investment, or even for internal planning and accounting, if the company owns personal property, machinery & equipment, it makes sense to consider valuing these assets as well.

A business appraisal will involve a review of the company’s financial statements, which include these tangible assets listed at some depreciated cost basis, and may not accurately reflect current market value. Especially if the property was purchased years ago and subject to a short-term, accelerated form of depreciation. This will lead to a likelihood that the net book value on the account ledgers for the personal property and equipment will be at or close to $0.

If the company being appraised will, in part, be affected by re-establishing the current value of the personal property and equipment, then engaging in a distinct appraisal for these assets should accompany the business valuation.

As an example, if the business appraiser is valuing a machine shop and, while reviewing the financial statements, finds a net book value of $100,000 in depreciated machinery & equipment, this is the figure he will use for the overall asset valuation analysis. If, however, an equipment appraisal is completed in conjunction with the valuation effort, and the current market value for these same assets is estimated at $500,000, then this figure will override the internal depreciated number, realizing a significant increase in overall tangible asset value.

This adjustment to the company’s books will truly reflect the overall value of the business and can be used for any of the purposes discussed earlier. It will also provide peace of mind to all parties involved in the larger transaction being reviewed, knowing that an independent third-party appraiser has updated the key components of the business that drive overall value.

There are a handful of appraisers in the marketplace who can value both the machinery & equipment and overall business for their clients. Many of them are larger, conglomerate-type companies who may overcharge you. Equipment Appraisal Services and our sister company, Business Valuation Specialists, can provide this capability to you at an affordable cost while delivering the highest level of service available. Contact us in the comments section below, at equipmentappraisal.com, or businessvaluations.net to see what we can do for you and your business.